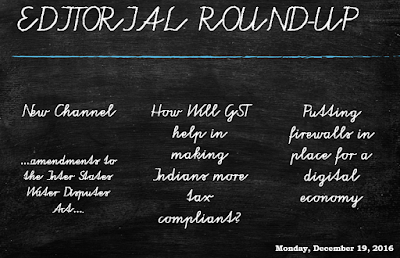

New

Channel

On December 15, the Union cabinet announced

wide-ranging amendments to the Inter-State Water Disputes Act, 1956.

Proposal: It has proposed an agency to collect and maintain water data including those

pertaining to rainfall, irrigation

and inter-basin flows.

Salience: Collection of data is the first step towards

resolving water disputes. The country has lacked a specialised agency for the purpose. The new agency will

ensure that water data is regularly

updated and this will obviate the haste to collect data every time

there is a water dispute.

Proposal: The cabinet has also decided to constitute a permanent tribunal to adjudicate on all

inter-state water disputes over river waters.

Salience: This will mean doing away with the current practice

of having a separate tribunal for every inter-state river dispute. In recent

times, the practice of creating a tribunal every time an inter-state water

dispute crops up, has been subject to criticism. The cabinet’s decision to

constitute a permanent tribunal is in

consonance with the National Water Policy 2012, which had pointed out

that a multiplicity of tribunals

militates against the early resolution of water conflicts and tribunals

often work at cross purposes.

Challenges

in Way Ahead:

The Constitution attaches a special status to

inter-state water disputes, whereby they neither fall under the Supreme Court’s

nor any other court’s jurisdiction. The courts can, at best, interpret a

tribunal’s award. The award is binding, but legal anomalies have meant that a

tribunal’s decision is not enforceable — one reason inter-state river disputes

have become virtually irresolvable.

Non-compliance of tribunal awards by states remains a

weak link in dispute resolution. That might persist even when there is a

permanent tribunal. Minimum improvement over previous arrangement will have to

be in this: Awards should be free of the legal anomalies of its ad hoc

predecessors and also try to work around the changing discourse of water

management.

Food for

thought: Rights of lower riparian

states or regions — and concomitantly duties of upper riparian regions — are

finding their way into water management discourses, globally. In recent times,

scholars and administrators have recognised the limitations of the

litigation-centred approach to resolving water disputes. What can be some other approached apart from litigation?

Administrative Morality?

XXXXX

How Will

GST help in making Indians more tax compliant?

GST allows those who pay tax on their supply of goods

or services to net out the tax they have paid on their inputs.

In order to claim input tax credit, producers would

want to procure their inputs only from suppliers who raise an invoice and levy

tax.

These suppliers, in turn, would procure their inputs

from other suppliers who also pay tax on their output.

Once everyone collects tax from those who purchase

their supplies, the volume of production that goes outside the tax net would

fall appreciably. Once most output gets reported, so would the associated

income.

Thus, transiting to GST is a reform that would expand

the base of both direct and indirect taxes.

However, for this potential to be realised, the

government must do things as well. One is to subsume stamp duty under GST,

treating registration as a service rendered for a fee on which service tax is

charged. Commercial establishments would then report their true value, so as to

maximise the input tax credit by way of tax paid on registration fees. This

would benchmark real estate transactions in general.

XXXXX

Putting

firewalls in place for a digital economy

Recently Prime Minister Narendra Modi declared that

people should make the digital

economy a way of life as it would be “transparent and effective”.

But there is a caveat: A digital economy comes with

its own pressure points and vulnerabilities.

In the words of a member of Legion—a hacker collective allegedly responsible for the

hacks of Indian politicians’ and media personalities’ Twitter accounts—in an

interview with FactorDaily last week, the group has “confidential data pertaining to NPCI [National Payments

Corporation of India] hub servers, and even the encryption keys/certificates used by some banks in India.

So, theoretically, we could generate ‘fraudulent’ financial messages! Does that

make #DigitalIndia safe?

Maybe Modi should think all of this through before launching it.”

The claim remains unverifiable for now. But the

government has taken it seriously enough for the ministry of electronics and

information technology under Ravi Shankar Prasad to mandate a cybersecurity audit of the financial

sector, review the Information

Technology Act and recruit expert

personnel to detect and respond to threats.

Instances of Cyber Security breaches in India:

* The debit

card hack affecting about 3.2 million cards earlier this year was among

the biggest ever financial data breaches in India.

* Also this year, Symantec,

a major global cybersecurity firm, claimed that a number of Indian

organizations—including central government systems, a financial institution and

a vendor to a stock exchange—had been breached by Suckfly, a cyberespionage

group.

* August saw details of the Scorpene submarine programme published online.

* In past years, a large number of valuable Indian

targets have been breached—from corporate entities and embassies to prominent

individuals and military institutions.

Instances of Cyber Security breaches globally:

* Hacking of US company Lockheed-Martin’s F-35 stealth fighter programme

* Massive wave of Russian

cyberattacks against Estonia and Georgia in 2007 and 2008, respectively.

* Or take old-fashioned theft—a remote affair now, as

the $81 million stolen from

Bangladesh’s central bank’s New York Federal Reserve account earlier

this year via malware attack on the Swift interbank transfer network

underscored.

* Data theft can be as damaging for both individuals

and corporations, perhaps more so. The just-revealed hack of a billion Yahoo accounts in 2013

illustrates just how vast the scope of such thefts can be.

Steps being taken in India to guard against Cyber

Attacks:

The Computer

Emergency Response Team (CERT-In), a nodal agency responsible for

dealing with cyber threats, was established in 2004. But it remains woefully

understaffed.

Centre is moving to set up a National Cyber Security Coordination Centre. But far too

many vulnerabilities remain.

Further Steps Required:

The government’s financial

outlay on cybersecurity is a fraction of what it needs to be, for

instance. It needs to go up.

Lack of effective

regulations and transparency must be addressed: Take the SEBI’s cybersecurity policy. It

requires reports on detected breaches to be quarterly—far too tardy to be of

much use. Nor does it mandate informing the public. That mandatory disclosure

of an attack or attempted attack must be implemented in both the public and

private sectors. The lack of it has a dual effect: it reduces the chances of

effective analysis, response and planning, and it contributes to the consumer

ignorance—and consequently, wariness—of digital transactions that is a major

barrier to Modi’s goal of a digital economy.

Modi’s vision of a digital economy—indeed, a digital

nation—is a fine one. But his government must also work on putting firewalls in

place.

No comments:

Post a Comment